Thorn Law Group Video Library

- View All Videos

- Firm News

- Offshore Accounts

- IRS

- Asset Forfeiture

- Criminal Tax

- Audits & Appeals

- International Tax

- Professional Responsibility

- Business Tax Issues

- Estate Planning

- Foreign Assets

- 2023-07-27 09:55:49

Kevin E. Thorn of the Thorn Law Group discusses Hunter Biden’s plea deal!

Tax Attorney Kevin E. Thorn Discusses the Hunter Biden Plea Deal - Full Interview

- 2020-02-12 08:06:32

Thorn Law Group Represents Cryptocurrency Targets. US citizens, green card holders and resident aliens investing in cryptocurrency may have received an IRS letter about reporting virtual currency transactions. If you received one of these letters from the IRS and need to amend past tax returns or are facing penalties, contact our legal team to help.

What To Do If You Received an IRS Letter For Cryptocurrency Transactions

- 2020-02-04 12:50:16

Washington DC tax attorney Kevin E. Thorn of Thorn Law Group has experience representing clients who have disputes with the Internal Revenue Service, Department of Justice, and/or state taxing agencies. Our firm represents and counsels clients all across the country and around the world on business and employment tax, criminal tax investigations, IRS audits and appeals, international tax issues and offshore account issues. Thorn Law Group attorneys worked for the IRS and the U.S. Tax Court before entering into private practice. Therefore, we are astutely positioned to handle your complex legal disputes. Our team of attorneys has experience litigating at the federal court level and understands the keen differences among the courts. We will help you strategically choose the best venue for you to try your case, whether it is the U.S. Tax Court, U.S. Court of Federal Claims or U.S. District court. Thorn Law Group is a service-oriented firm with the extensive knowledge and innovative technology to meet your every need. We have the expertise needed to resolve all of your tax concerns. Our lawyers have handled all types of tax issues including income tax problems, payroll tax problems, valuation disputes, TEFRA litigation, excise tax problems, tax collection, tax penalties, and estate tax cases. To learn more about how Thorn Law Group can help you with your tax and legal issues, contact Kevin E. Thorn, Managing Partner, at ket@thornlawgroup.com or (202) 270-7273.

Tax Attorney Washington DC - Thorn Law Group - Civil and Criminal Tax Matters

- 2019-10-08 11:41:49

Thorn Law Group was founded to help both individuals and businesses from across the country and around the globe solve their international tax issues. Whether you are an individual living abroad or someone conducting business in the United States for the first time, our former IRS attorneys and international tax law advisors can help you with your international tax needs. To learn more about how a DC IRS lawyer at Thorn Law Group can help you with your tax and legal issues, contact Kevin E. Thorn, Managing Partner, at ket@thornlawgroup.com or (202) 270-7273.

DC IRS Lawyer - International Tax Law Advisor

- 2019-10-08 11:42:15

If you are a US taxpayer, trust, or company and have undisclosed offshore accounts, then you need your own representation to protect your interests. Call DC tax attorney Kevin E. Thorn. For a free consultation or to learn more about how America's tax amnesty litigator can help you enter into the IRS's Voluntary Disclosure Amnesty Program, call 202-349-4033 or visit https://www.thorntaxlaw.com/.

DC Tax Attorney - Undisclosed Offshore Accounts

- 2019-10-08 11:42:41

DC tax attorney Kevin Thorn of Thorn Law Group reminds you that it is not illegal to have foreign bank accounts. Many of our clients at Thorn Law Group have offshore accounts for various legitimate reasons. They may have inherited the funds from relatives, or they might be hedging their investments in foreign currencies as a part of an investment strategy. Regardless of the reason, it is a crime to hold these offshore accounts without disclosing them to the government. Taxpayers who hold offshore accounts must disclose the existence of such accounts, and report any income derived from them to the Internal Revenue Service. An experienced lawyer can help any taxpayer who wishes to claim an undisclosed offshore account without facing harsh penalties or criminal prosecution. Our firm is experienced helping taxpayers navigate the intricacies of the IRS's Offshore Voluntary Disclosure Program for Undisclosed Offshore Accounts. Voluntary Disclosures offer a great opportunity for taxpayers to avoid potential criminal prosecution. However, voluntary disclosures are also complex legal matters that are subject to strict guidelines. Call DC tax lawyer Kevin Thorn at 202-349-4033 to help guide you through completing a voluntary disclosure.

Tax Attorney Washington - IRS Voluntary Disclosure Program - Thorn Law Group

- 2019-10-08 11:42:42

At Thorn Law Group, our attorneys currently represent numerous clients with undisclosed foreign bank accounts. Contrary to popular belief, it is not illegal or criminal to hold an offshore bank account. However, as Washington DC tax lawyer Kevin Thorn reminds, it is illegal to not claim or pay U.S. taxes on your foreign bank account. Your trusted tax lawyer at the Washington DC office of Thorn Law Group warns that the U.S. government is cracking down on individuals utilizing offshore accounts in an attempt to evade U.S. tax liabilities. Luckily, the IRS has offered an IRS Amnesty Program encouraging individuals or businesses to come into compliance and voluntarily disclose their accounts. We bring a unique perspective to Foreign Bank Account Reporting. Our team is comprised of former IRS attorneys and United States Tax Court clerks, who utilize their field experience and knowledge to get you a more beneficial settlement. If you would like to participate in the IRS Amnesty Program, then a DC IRS lawyer with Thorn Law Group can help you navigate the intricacies of each tax form, to ensure you have completed it correctly.

Washington DC Tax Lawyer - Thorn Law Group - Offshore Account Reporting

- 2019-10-08 11:42:43

The IRS has reinvigorated its asset forfeiture program -- a program that allows the IRS to seize taxpayer assets. Asset forfeiture laws allow the IRS to seize a taxpayer's assets that were allegedly bought with the proceeds from illegal activity or used in that illegal activity. The IRS can seize assets such as bank accounts, investments, computers, cars, and even houses. However, as an experienced Washington DC tax attorney knows, oftentimes the IRS seizes assets improperly.

As former government employees, the attorneys at Thorn Law Group know the operational procedures and the regulations that IRS revenue agents are required to adhere to. This gives your DC tax attorney the upper-hand while evaluating your tax dispute or the seizure of your assets. The attorneys at Thorn Law Group are service-oriented; we provide high-quality legal services with extensive financial and legal knowledge, and the newest technology to stay abreast of every tax or IRS update.

If the IRS has seized your property, it is imperative that you seek a representative quickly so that you can protect your rights and reclaim your property. Oftentimes your property is seized improperly. Call Thorn Law Group at 202-349-4033 immediately to discuss your legal options.

Washington DC Tax Attorney - Thorn Law Group - Asset Forfeiture Program

- 2019-10-08 11:44:03

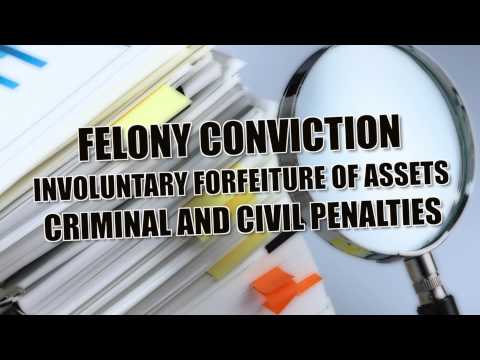

Kevin E. Thorn of Thorn Law Group discusses why it's important to hire a competent Washington DC tax lawyer if you are the target of a government investigation into alleged criminal misconduct.

The U.S. government and Internal Revenue Service take the violation of criminal tax laws very seriously. If you are facing a criminal tax investigation, you need an experienced attorney to represent your case. Because the attorneys at Thorn Law Group are former government attorneys, we are able to thoroughly evaluate your situation to determine and pursue the best result possible for your criminal tax issue.

IRS agents are aggressively conducting in-depth investigations into individuals and businesses to uncover financial crimes including: general tax fraud, return preparer fraud, questionable refunds, employment tax fraud, voluntary disclosures, excise tax fraud and undisclosed offshore accounts. If found convicted the courts often hand down substantial prison sentences and require the criminal to pay hefty fines, penalties and interest on top of any back taxes owed.

At Thorn Law Group, an experienced DC tax lawyer will help you to cooperate with investigators as required by law, while fully asserting any available defenses you may have including your right against self-incrimination. If you are the target of a Government investigation into alleged criminal misconduct, contact Kevin E. Thorn, Managing Partner, at ket@thornlawgroup.com or (202) 270-7273.

Washington DC Tax Lawyer - Thorn Law Group - Criminal Tax Law

- 2019-10-08 11:44:04

DC tax attorney Kevin E. Thorn understands the tolls that an IRS tax audit can take both emotionally and financially. The stress alone induced by an IRS tax audit can be enough to make your head swim. Thorn Law Group has been representing individual taxpayers, businesses, trusts, partnerships and other entities who are facing a civil audit from the Internal Revenue Service.

At Thorn Law Group, our attorneys are former representatives of the Internal Revenue Service and know how the revenue agents are expected to proceed in civil tax audits. Thus, our attorneys are well positioned to represent our clients in complex audit situations. We coordinate with the IRS revenue agents at the onset of the audit process to determine the audit parameters. Then, we coordinate with the taxpayer to present his or her materials in the most effective manner.

A DC tax lawyer at Thorn Law Group will work hard to ensure that your rights are protected, and prevent any abuses from the IRS. We work directly with our clients to resolve any tax issues and close audits as quickly as possible with the least amount of fees or penalties incurred.

If you or your business is facing an IRS audit, do not stress. Simply contact a DC tax attorney at Thorn Law Group. Our attorneys have the experience and financial knowledge to resolve your disputes efficiently.

DC Tax Attorney - Audits & Appeals - Thorn Law Group

- 2019-10-08 11:44:05

Today, international connections have become commonplace, whether these connections are made by international bank accounts, foreign subsidiaries or international business partners. While globalization offers opportunities for growth, it also introduces the potential for misdeeds and conflicts. Navigating the rough legal seas of international compliance can be difficult, but a Washington DC tax attorney at Thorn Law Group can help.

The IRS has announced specific plans to aggressively pursue international tax violations by focusing on combating tax fraud and tax evasion by auditing U.S. taxpayers who use foreign accounts and offshore business entities in ways the IRS deems abusive. Luckily, the lawyers at Thorn Law Group have experience helping our international clients handle these types of IRS investigations.

The IRS plans to increase audits and investigations of U.S. individual and business taxpayers with foreign sourced income, foreign bank accounts and foreign trusts. Be prepared for when the IRS comes to investigate your foreign accounts. Consult with a Washington DC IRS lawyer about your international circumstances.

Thorn Law Group has helped U.S. citizens living and working abroad, U.S. citizens with foreign-sourced income, U.S. taxpayers with international trusts, Non-U.S. taxpayers with U.S. sourced income, U.S. and non-U.S. entertainers with worldwide income, and U.S. businesses with operations in other countries.

Washington DC Tax Attorney - Thorn Law Group - International Tax Disputes

- 2019-10-08 11:44:06

When a tax professional's reputation is on the line, it is imperative that you hire a professional DC IRS attorney to represent your case. At Thorn Law Group, our lawyers have the experience and the professionalism necessary in dealing with government investigators. We focus our practice on representing tax professionals, law firms, accounting firms and other businesses facing government investigations and professional malpractice allegations.

Each DC IRS attorney at Thorn Law Group has extensive experience representing both individuals and firms before the Internal Revenue Service, the Internal Revenue Service's Office of Professional Responsibility, the Department of Justice, and the United States Tax Court. Our lawyers know the ins-and-outs of IRS investigation procedures and utilize this knowledge to meticulously examine your case and strategically formulate an argument that places you in the best possible position.

DC IRS Attorney - Thorn Law Group - IRS Office of Professional Responsibility

- 2019-10-08 11:44:07

A DC tax attorney at Thorn Law Group can help individuals file their IRS Whistleblower claim. The Internal Revenue Service encourages individuals to come forward and expose other individuals, businesses, trusts, partnerships and other entities that underpaid their taxes or committed tax fraud. Although the IRS rewards whistleblowers for information leading to the successful recovery of due taxes, filing a whistleblower claim can can be a complicated and intimidating practice. The attorneys at Thorn Law Group are experienced in the processes and stipulations of the IRS Whistleblower Program.

Hiring a tax attorney in Washington DC will give you the confidence that your whistleblower claim is appropriately established and documented. The attorneys at Thorn Law Group are seasoned professionals who will respect your privacy and keep your identity confidential until it is necessary by law to reveal. Contact a DC tax attorney at Thorn Law Group if you would like more information regarding how we help our clients with whistleblower cases.

DC Tax Attorney - Thorn Law Group - IRS Whistleblower Program

- 2019-10-08 11:44:09

In today's constantly changing world, individuals are forced to deal with complicated tax laws from different countries. U.S.-based companies transacting business overseas especially face additional challenges in terms of tax compliance. A DC tax lawyer at Thorn Law Group can help you navigate our complicated, tax-changing world. It is important not to be caught off-guard when the IRS comes to investigate your foreign accounts. At Thorn Law Group, our experienced lawyers can represent you in offshore and foreign account cases and help you handle IRS investigations. To learn more about how a DC tax lawyer at Thorn Law Group can help you with your international tax issues, contact Kevin E. Thorn, Managing Partner, at ket@thornlawgroup.com or (202) 270-7273.

DC Tax Lawyer - International Tax Issues

- 2019-10-08 11:47:22

At Thorn Law Group, many of our clients come to us with serious tax matters before the IRS. These often involve payroll, trust fund recovery, and worker classifications type tax issues. We take our clients' business tax issues very seriously. A Washington DC tax attorney at Thorn Law Group can take control of the situation and enable you to operate your business. Our attorneys have the knowledge and expertise to help you with business tax matters.

Washington DC Tax Attorney - Business Tax Issues

- 2019-10-08 11:47:23

The attorneys at Thorn Law Group represent clients in criminal tax investigations across the country and around the globe. We represent individuals, businesses, trusts, and banks before the IRS, the Department of Justice, and other government agencies. We pride ourselves in solving our clients' most sensitive legal issues. If you are the target of a government investigation into alleged criminal misconduct, you will want a Washington DC IRS attorney by your side to provide effective legal representation.

Washington DC IRS Attorney - Criminal Tax Investigations

- 2019-10-08 11:47:24

At Thorn Law Group, our knowledgeable and experienced attorneys successfully represent clients under audit in three stages: First, we identify the issue. Second, we come up with a plan to attack the audit. Third, we resolve the client's issue successfully. Undergoing an audit can be a very stressful time. Let a Washington DC tax attorney at Thorn Law Group manage the stress of dealing with the IRS, protect your rights and interests, and aggressively defend your reporting positions.

Washington DC Tax Attorney - IRS Audits and Appeals

- 2019-10-08 11:47:24

The Voluntary Disclosure Program has received renewed interest lately. On January 9, 2012, the IRS introduced the reopening of its Offshore Voluntary Disclosure Program for undisclosed offshore accounts. At Thorn Law Group, we represent individuals, businesses, trusts, and banks in the IRS Voluntary Disclosure Program. As former IRS attorneys, we have the knowledge and experience to resolve your voluntary disclosure favorably.

Tax Attorney DC - Estate Planning and Wealth Management

- 2019-10-08 11:47:25

Thorn Law Group and its attorneys have the expertise and knowledge to help with your estate planning and wealth management issues. We represent clients nationally and internationally who are in the process of settling their estate.

Washington DC Tax Attorney - IRS Voluntary Disclosure Program

- 2019-10-08 11:47:25

The tax world as we know it is changing - both nationally and internationally. Disclosure requirements of foreign assets are becoming more difficult. At Thorn Law Group, a DC IRS attorney can help you disclosure your foreign assets, whether you are an individual, business, trust, or bank. Our attorneys have the knowledge and expertise to help you with your FATCA reporting requirements.

DC IRS Attorney - Foreign Asset Reporting

- 2019-10-08 11:49:17

At Thorn Law Group, our DC IRS attorneys have experience successfully representing clients form all over the globe. We consult with counsel throughout the world on business and employment tax, criminal tax investigations, IRS audits and appeals, international tax issues, and offshore accounts issues. If you need assistance finding the most advantageous tax resolution possible to settle your tax disputes, contact Kevin E. Thorn, Managing Partner and DC tax lawyer, ket@thornlawgroup.com or (202) 270-7273 for a free consultation.

DC IRS Attorneys - Thorn Law Group - Capital Insider

- 2019-10-08 11:49:17

Washington DC tax attorney Kevin Thorn, managing partner of Thorn Law Group, is interviewed on Let's Talk Live. Thorn Law Group is a boutique litigation firm that specializes in representing people before the IRS, the Department of Justice, the US Tax Court, as well as other taxing authorities. While it is not illegal to have an offshore bank account, it's important that you disclose the account to the US government. Otherwise, you may face serious consequences. If you have a bank account outside the United States, it's important to speak with an experienced DC tax attorney who works in this area of law and can educate you on what needs to be done about your offshore account. Every situation is different. Thorn Law Group can help. Contact Kevin E. Thorn at ket@thornlawgroup.com or (202) 270-7273 for more information.

A Washington DC Tax Attorney Can Help With Your Offshore Bank Accounts

- 2019-10-08 11:55:01

Kevin E. Thorn Managing Partner of Thorn Tax Law Group on NewsChannel 8's Let's Talk Live discussing the IRS Changes to their 2012 Voluntary Disclosure Program/Amnesty Program.

Thorn Law Group, led by founding tax attorney Kevin E. Thorn, is an experienced and sought after Washington DC tax law firm focused on successfully representing your sensitive federal tax disputes, tax controversies and tax litigation problems. Thorn Law Group represents clients all over the United States and in many foreign countries and consults with counsel throughout the world on Business and Employment Tax, Criminal Tax Investigations, IRS Audits and Appeals, International Tax Issues as well as Offshore Account Issues.

Kevin E. Thorn, Thorn Tax Law Group on Let's Talk Live 6-27-14

- 2019-10-08 11:49:17

A new IRS amnesty deadline is looming, and U.S. citizens could face major penalties on their offshore account balances. DC tax attorney Kevin E. Thorn talks about this deadline and what it really means in this episode of Let's Talk Live. Kevin E. Thorn is the managing partner of Thorn Law Group, a law firm that is committed to working with clients to develop best strategies and solutions to resolve tax issues arising out of offshore bank accounts. To discuss your offshore bank account concerns and the new IRS amnesty deadline, contact Kevin E. Thorn at ket@thornlawgroup.com or (202) 270-7273 for more information.

Kevin E. Thorn, Thorn Tax Law Group on Let's Talk Live 7-25-14

- 2019-10-08 11:49:17

Kevin E. Thorn, Washington DC tax attorney, appears on Let's Talk Live to offer advice about the Swiss banks' program to encourage voluntary disclosures and how this affects US taxpayers with offshore bank accounts. As former IRS attorneys, the attorneys at Thorn Tax Law Group are experts in tax law and have experience with these voluntary disclosure programs. If you need assistance with your offshore bank account, contact Kevin E. Thorn, Managing Partner and DC IRS lawyer, at ket@thornlawgroup.com or (202) 270-7273 for more information.

Washington DC Tax Attorney Discusses Swiss Banks Voluntary Disclosures

- 2019-10-08 11:49:18

The newly enacted Foreign Account Tax Compliance Act (FACTA) can be a confusing subject for taxpayers. Washington DC tax attorney Kevin E. Thorn of Thorn Law Group explains the details of FATCA on Let's Talk Live. As Thorn explains, FATCA is a law put into place to force financial institutions in other countries to disclose US taxpayers’ undisclosed account information. If you have received a letter from a bank overseas, you should contact a DC tax attorney. Thorn Tax Law Group has experience in international tax compliance.

Washington DC Tax Attorney Kevin E. Thorn Discusses FATCA

- 2019-10-08 11:49:20

New U.S. tax laws are affecting expats and citizens who work overseas. DC tax lawyer Kevin E. Thorn of Thorn Law Group provides tax counsel and legal representation to clients around the world. He appears on Let’s Talk Live to discuss the Foreign Account Tax Compliance Act, or FATCA, which regulates people who have offshore accounts through banks. If this law affects you and you have questions about what you need to do, contact Thorn Law Group for more information.

DC Tax Lawyer Kevin E. Thorn Discusses FATCA